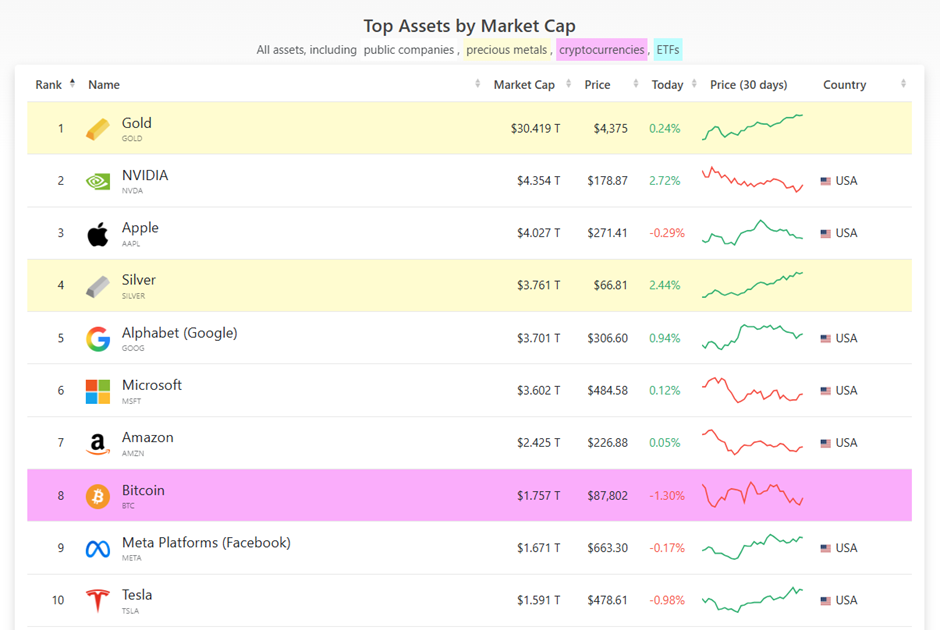

Silver Joins Gold, Nvidia, and Apple at the Top of Global Assets

来源于:英为-推荐

发布日期:2025-12-23 09:34:27

Silver breaks into the top four, central banks keep buying gold, and US households lean more into equities than property.

1. Silver Breaks Into the Top FourSilver’s recent surge has lifted it to the fourth-largest asset globally by market capitalisation, overtaking Alphabet (Google). With a market cap of roughly $3.7 trillion, silver now sits behind only gold, Nvidia, and Apple.

Source: companiesmarketcap.com

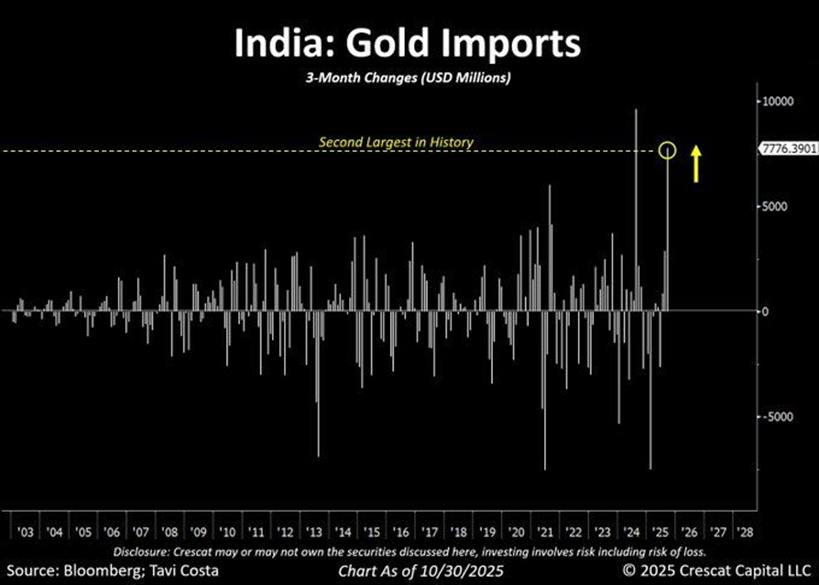

2. Central Bank Gold Buying ContinuesIndia has just posted the second-largest three-month increase in gold reserves on record, underscoring that central banks’ appetite for gold remains strong.

Source: Tavi Costa, Bloomberg

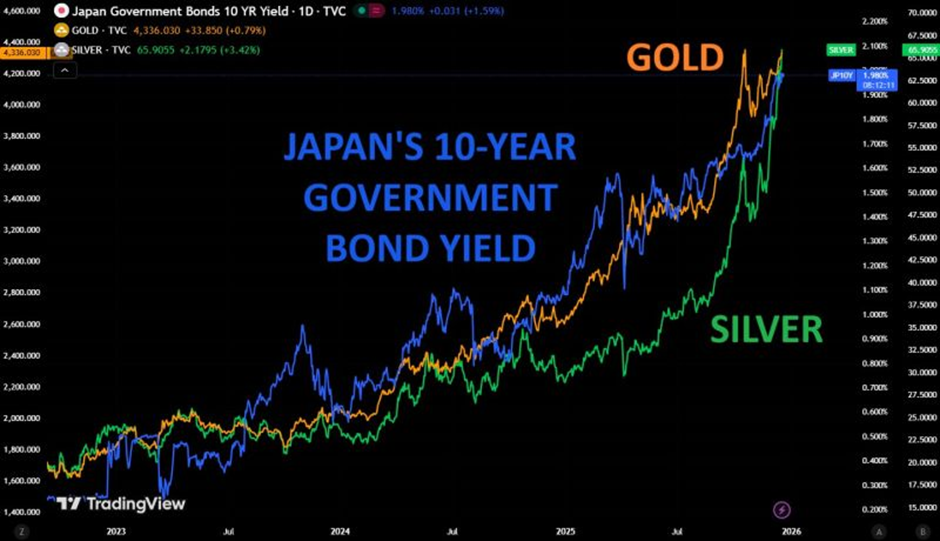

3. Precious Metals Are Tracking Japanese Bond YieldsJapan’s 10-year government bond yield has climbed by roughly 1.5 percentage points since early 2023, reaching about 1.98%, its highest level since the 1990s. Over the same period, gold and silver have surged by around 135% and 175%.

Are precious metals increasingly being used as a hedge against the growing cost of government debt?

Source: Global Markets Investor

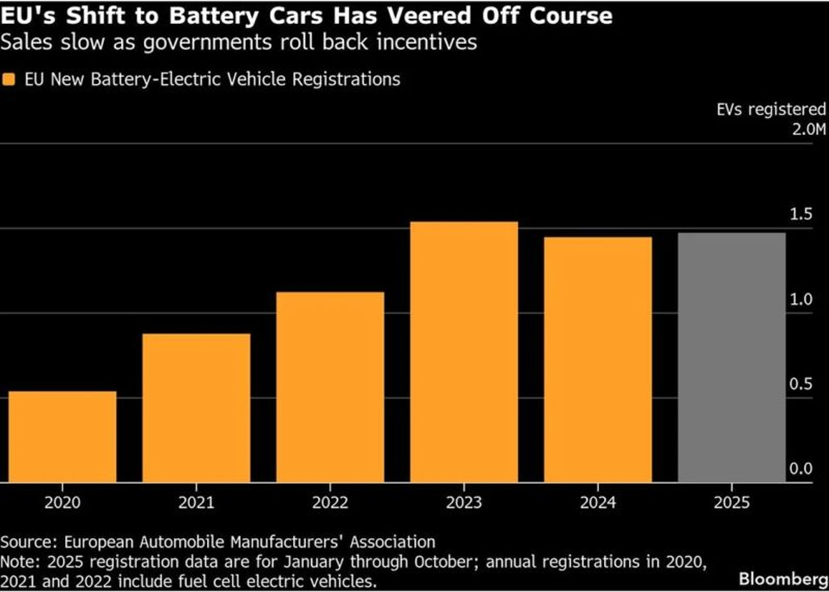

4. Europe Slows Its Push Toward an EV-Only FutureThe phase-out of combustion engines was set for 2035, but market realities have forced a major shift. The EU has stepped back from a full ban, moving from a 100% emissions reduction target to 90%.

For automakers, this means gasoline, diesel, and plug-in hybrids can still be sold beyond 2035. Manufacturers are also being given more flexibility, with options to offset emissions through low-carbon fuels or cleaner materials instead of committing exclusively to electric vehicles. After heavy losses in EV programmes, including a $19.5 billion charge at Ford, the industry is signalling that the economics are not yet viable.

More broadly, Europe is converging toward the US approach. Faced with trade tensions, weak manufacturing growth, and pressure on industrial competitiveness, policymakers are prioritising economic stability over rigid climate targets. The takeaway is simple: transitions can be mandated, but demand and profitability cannot.

Source: Bloomberg, Financial Post

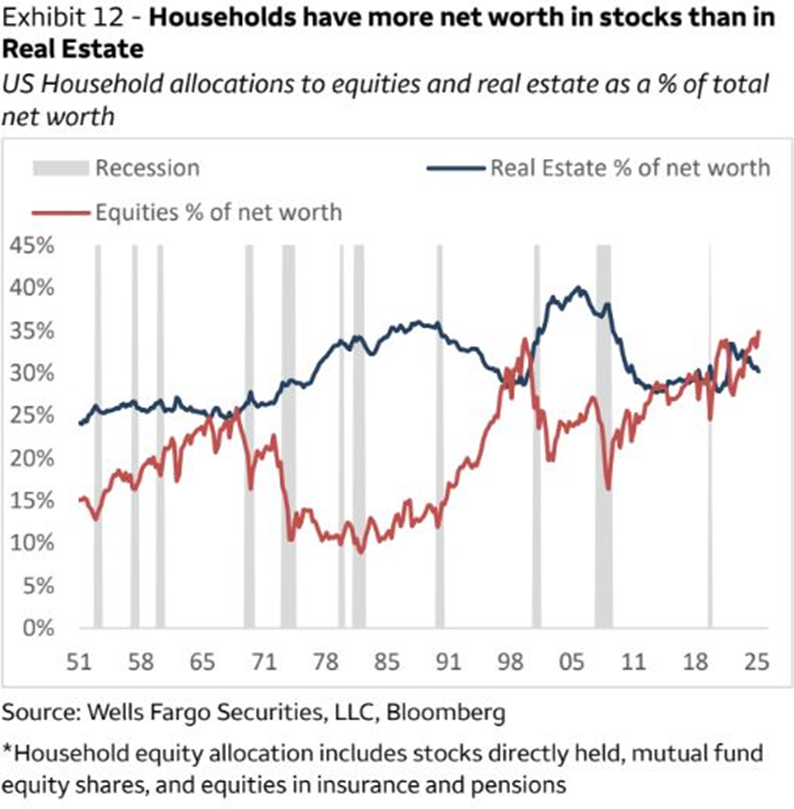

5. US Households Are More Exposed to Equities Than Real EstateThe US is in a relatively rare situation where household wealth invested in the stock market now exceeds wealth held in physical real estate. This crossover has only occurred a few times in modern history, most notably in the late 1960s and the late 1990s, and both episodes were followed by prolonged bear markets.

In practical terms, households are increasingly concentrated in equities, making overall wealth more sensitive to market volatility. When portfolios are dominated by stocks, downturns translate quickly into losses, whereas real estate typically adjusts more slowly and with less day-to-day volatility. With so much wealth tied to equities, the US government has limited tolerance for a deep bear market. The question is whether this sets the stage for a policy backstop, potentially a “Trump put,” heading into 2026.

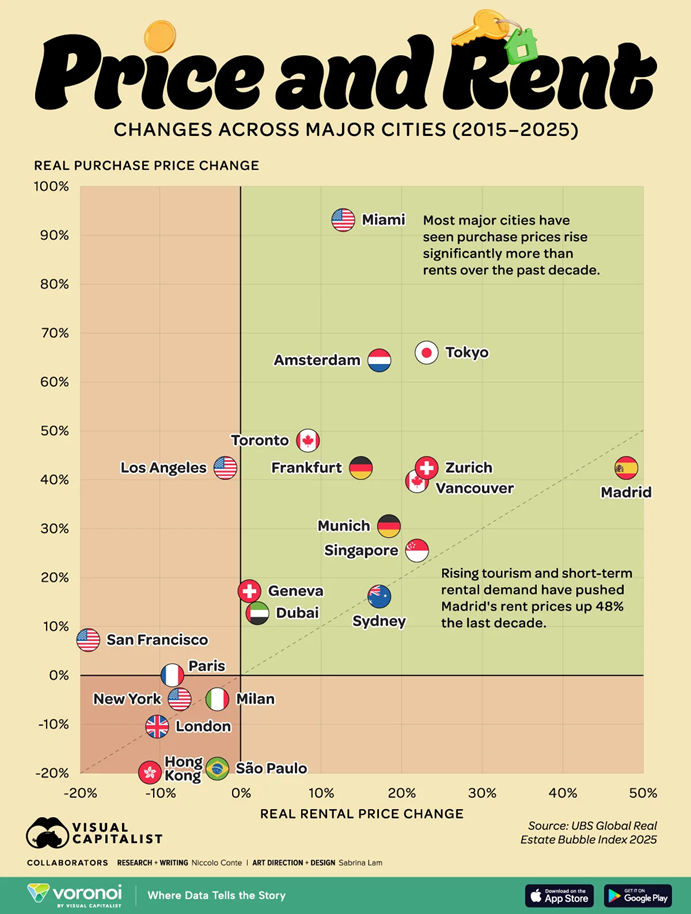

Over the past ten years, the global real estate landscape has changed dramatically, with the gap between buying and renting widening sharply across major cities. Data from the UBS Global Real Estate Bubble Index (2015–2025) shows a clear divergence between home prices and rents, with very different outcomes depending on location.

Miami stands out as an extreme case. Real home prices have surged by 93.1%, while rents increased by just 12.7%, making it one of the strongest markets globally for capital appreciation. Madrid tells a different story, marked by an intense rental squeeze. Home prices rose by 42.4%, but rents climbed even faster, up 48.0%, the steepest increase among major global cities, driven by tourism and the expansion of short-term rentals.

Some traditional safe havens have cooled. In London, both home prices and rents are down 10.5% since 2015, reflecting the combined effects of Brexit and an outflow of high-net-worth residents. Milan has also seen a mild but persistent decline, with property prices down 4.9% and rents down 3%.

In contrast, German-speaking cities have remained relatively stable growth hubs. Zurich recorded a 42.4% increase in home prices and a 23.1% rise in rents, while Munich saw gains of 30.5% and 18.4%, respectively. The overall picture highlights a fragmented global housing market, where affordability, returns, and risk increasingly depend on geography rather than broad global trends.

Source: Visual Capitalist, Voronoi, UBS

7. Merry ChristmasTechnical analysis, reinvented with a Novo Nordisk Christmas tree.

It’s the most wonderful time of the year.

Merry Christmas!

Source: Trend Spider

温馨提示:本站所有文章来源于网络整理,目的在于知识了解,文章内容与本网站立场无关,不对您构成任何投资操作,风险 自担。本站不保证该信息(包括但不限于文字、数据、图表)全部或者部分内容的准确性、真实性、完整性、原创性。相关信 息并未经过本网站证实。

分享到